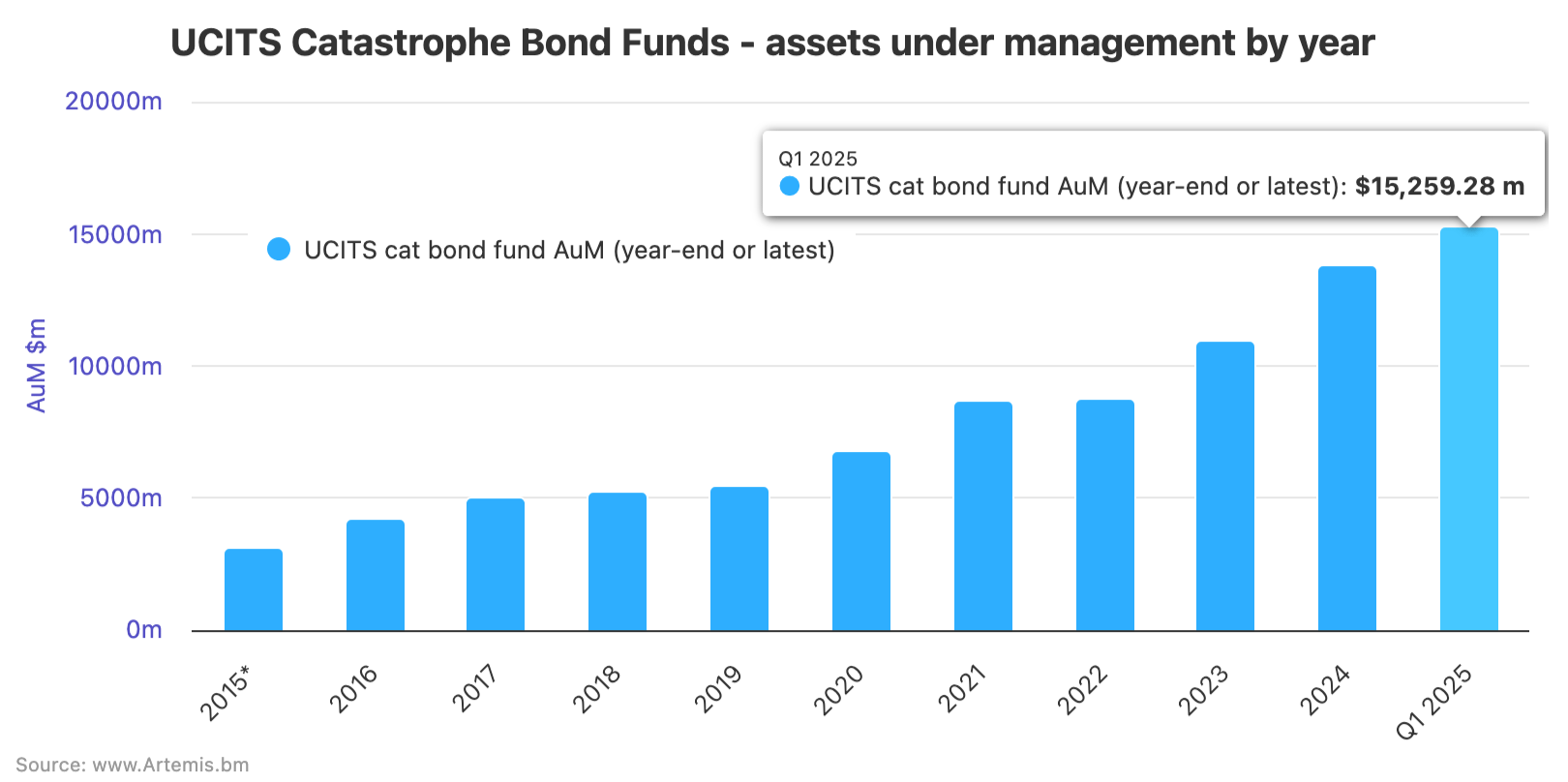

UCITS catastrophe bond funds grew 11% to record-high $15.3bn AUM in Q1 2025

Catastrophe bond funds in the UCITS format accelerated their growth in the first-quarter of 2025, with cat bond assets under management across the now seventeen UCITS cat bond fund strategies growing 11% to reach a new record-high of just under $15.3 billion.

UCITS catastrophe bond funds had been growing strongly last year, hitting a new high of just over $13.8 billion in cat bond assets under management at December 31st 2024, adding an impressive 26% over the course of the twelve-month period.

With catastrophe bond issuance starting off 2025 on record-setting pace, thanks to the $7.1 billion of issuance we analysed in our recent cat bond market report, these UCITS format cat bond fund strategies have continued to expand to grow their capital to support cat bond sponsor needs for reinsurance capital.

Over the course of the first-quarter of 2025, the seventeen UCITS cat bond fund strategies added over $1.45 billion in new assets under management, with more than $1 billion of this added in March 2025 alone.

Some of this will have come from coupon earnings, but given the effects of the wildfires in California also dented valuations of exposed cat bond positions it seems the new inflows will by far have been the main driver of growth.

The first-quarter of 2025 resulted in an impressive 11% increase in assets under management (AUM) across the seventeen UCITS catastrophe bond fund strategies, which ended the period at March 31st 2025 with a combined almost $15.3 billion in cat bond AUM.

Analyse UCITS catastrophe bond fund assets under management using these charts (data kindly shared by our partner Plenum Investments AG, a specialist insurance-linked securities (ILS) fund manager).

As a result of the very strong first-quarter of assets under management expansion, the UCITS catastrophe bond fund segment has now grown by a significant 30% in just one year.

Which is an acceleration of pace, since the growth over full-year 2024 of 26%.

This was assisted by the launch of a new UCITS cat bond fund strategy in March 2025, as the awaited RenaissanceRe Medici UCITS Fund began its operations with an initial $340 million of capital.

Alongside which, the majority of other UCITS cat bond funds have also continued to grow in Q1 2025, helping to drive the new record-high AUM across the UCITS segment.

The big three UCITS cat bond funds now account for two-thirds of assets across the group, with $10.04 billion across them.

As a result, the three largest UCITS cat bond funds now contribute 66% of the total AUM for the segment at the end of Q1 2025, which is slightly down from 68% at the end of 2024, meaning that while the segment is growing the share of the largest three funds has been declining somewhat given the growth seen at so many other cat bond fund strategies.

If we add in the Leadenhall UCITS ILS Fund, UCITS cat bond fund strategies with more than $1 billion in AUM made up almost $11.2 billion of the total, the Leadenhall Capital Partners fund having grown over 5% in the quarter to reach more than $1.15 billion.

The Schroder GAIA Cat Bond Fund ended the Q1 2025 period as the largest of the UCITS cat bond funds, with just over $3.8 billion of assets.

Next is the Twelve Cat Bond Fund at almost $3.66 billion, followed by the GAM Star Cat Bond Fund at almost $2.57 billion.

The top two, the UCITS cat bond strategies from Schroders and Twelve Securis, both grew their AUM by more than 9% each in the first-quarter of 2025, but the GAM Star strategy shrank slightly.

The most significant AUM growth in Q1 2025 came from the Icosa Cat Bond Fund, which added 33% to reach $425 million by the end of March.

Next fastest in growth terms was the AXA IM Wave Cat Bond Fund, which grew by over 30% to reach almost $328 million in the period.

Of the others growing by 10% or more: The Plenum CAT Bond Defensive Fund grew by almost 18% to reach $480 million; the Solidum CAT Bond Fund grew 13% to $103 million; the HSZ Group Maneki UCITS Cat Bond Fund grew 12% to $63 million; the Plenum CAT Bond Dynamic Fund grew 11% to $247 million; and the Franklin K2 Cat Bond Ucits Fund strategy grew 10% to almost $158 million.

Depending on how you measure catastrophe bond risk capital outstanding, using our measure of $52.2 billion at the end of Q1 2025, at almost $15.3 billion in combined assets the group of UCITS cat bond funds made up more than 29% of outstanding cat bond market capital as of the end the first-quarter (you can analyse Artemis’ measure of this here).

That indicates a slight outpacing of overall cat bond market growth for these UCITS cat bond funds, as at the end of 2024 the group contributed 28% of the total risk capital in the catastrophe bond market.

With a combined nearly $15.3 billion in catastrophe bond assets under management across the UCITS cat bond fund strategies at the end of March 2025, this group have now grown by 30% in one year, but by an impressive 63% in two years and 76% in just three years.

Theses UCITS cat bond fund strategies have continued to expand their importance to the catastrophe bond market, making up an increasing proportion of the overall marketplaces assets and growing as a share of insurance-linked securities (ILS) capital overall.

As a result, the UCITS cat bond funds are a growing contributor to third-party investor backed reinsurance capacity overall, which has been welcomed by insurance and reinsurance firms as they continue to look to the catastrophe bond as an efficient source of reinsurance from the capital markets.

The catastrophe bond market pipeline is already building for the second-quarter of 2025 and the cat bond market yield remains at a historically high level, which should continue to attract both sponsors and investors, providing opportunities for cat bond fund managers to attract new inflows and continue to grow.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

You can also analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.