The level of cat bond and parametric work we’re doing is exceptional: Aon CEO

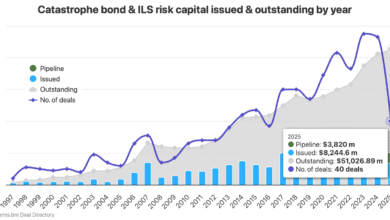

Having reported another quarter of double-digit revenue growth for its catastrophe bond and insurance-linked securities (ILS) related activities, Greg Case the CEO of broking giant Aon also highlighted parametric risk transfer as another area he sees activity levels as exceptional in.

“Reinsurance with 4% organic revenue growth was driven by growth in treaty placements and double-digit growth in both facultative placements and insurance-linked securities,” Aon CFO Edmund Reese explained during a first-quarter earnings call just now.

Adding that, “This growth was partially offset by the impact of a multi-year extension with a significant client at higher limits and adjusted commission.

“Looking ahead to the second quarter, we expect softer market conditions with April 1 property rates in both the US and Japan down 5% to 20%.

“Importantly, we expect full-year organic revenue growth in-line with our mid-single digit or greater objective, as we see a strong second-half driven by higher limits at July 1 renewals, continued growth in our international facultative placements and strength in our strategy and technology group.”

CEO Case also suggested demand for reinsurance limit is expected to rise at the mid-year renewals, reflecting expectations from others in the market at this time.

Greg Case discussed the organic revenue metric for the reinsurance division at Aon during the call as well.

“Think about what’s going on in reinsurance right now for us, we’re building our core momentum and really this is what we do at a segment level with our clients, but really differentiating on analytics. What we’ve invested in Aon Business Services and with Risk Capital has been really, for us, meaningful, really tour-de-force.

“We’re winning more than ever before in this context, on the reinsurance and the commercial risk side, and this Risk Capital construct is also meaningful,” Case said.

Continuing to explain that, “You know, the level of cat bond and parametric work we’re doing is exceptional and driven by Risk Capital and the strategic technology group also reinforcing and driving progression.

“So, the 4% which you know, it’s treaty placements, it’s double-digit growth in facultative, another double digit growth in insurance-linked securities. So net net, it’s strong progression overall.”

Case also discussed the alternative risk transfer and parametric segments of the broker’s offering, seeing it as an area that is growing.

“One of the things that was interesting is alternative risk transfer continues to be highly prevalent, and the work we’re doing with reinsurance in the commercial risk arena on alternative risk transfer is substantial,” Case explained.

Later he highlighted a recent parametric risk transfer win for Aon, saying, “We just did a massive, I think the biggest parametric on a severe convective storm that’s ever been done for a big steel company and it really was in the face of, you know, this new set of risks that are on the horizon and how they can deal with that. So for us, we’re tailoring solutions against this.”

Aon, through its Aon Securities unit, has been a leading broker and investment bank in the catastrophe bond space for many years and continues to grow this business as the ILS market expands.

Now, with use of parametric triggers expanding across insurance and reinsurance, the broker is also finding this risk transfer product another area of incremental revenue growth.

Read more on Aon’s Q1 2025 results over at our sister publication Reinsurance News.