Strong cat bond issuance takes some excess cash out, prices a little firmer: K2 Advisors

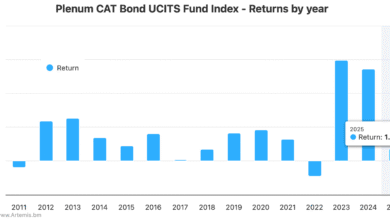

Robust catastrophe bond issuance in the first and now second quarter of 2025 seems to have taken some of the excess cash out of the market, leading to a little more firmness in pricing of late, K2 Advisors, the hedge fund focused investment management unit of Franklin Templeton has noted.

One quarter on and it seems the investment manager has got its wish, as catastrophe bond issuance has been particularly brisk, with records being broken for new cat bonds coming to market year-to-date.

That brisk cat bond issuance has helped to absorb much of the cash that has been flowing from maturing deals, as well as from new inflows from cat bond fund managers.

K2 Advisors said, “Cat bond issuance has been strong. The market remains healthy and has exhibited some firmness as of late regarding spreads, as deals have priced within or higher than initial guidance in addition to getting upsized.”

Here, the investment manager is referring to the fact pricing has in fact been closer to guidance so far in Q2 than it was in Q1 this year.

In the first-quarter of 2025, new cat bond tranches issued priced almost 10% below their mid-points of initial guidance, on average.

But, in Q2 so far, Artemis’ data shows that the pricing trend is for just a -3.4% fall from guidance mid-points so far this quarter.

K2 Advisors believes this shows more firmness in the catastrophe bond market, which can often be one way a more balanced supply-demand in capital terms gets exhibited.

Of course, it can also mean the initial guidance was more realistic at the start of an offering, so less drastic price decreases are seen.

Discussing the fall-out from the California wildfires in Q1, K2 Advisors noted that a lot of the mark-to-market decline in cat bonds seen from the event was recovered, with most of the bonds that now remain marked-down having contributions from other natural catastrophe perils as well.

K2 Advisors commented, “Despite this severe event, the market remained robust with issuance, as new and returning sponsors are coming to the cat bond market to fulfill their capacity needs.

“Overall, primary issuance remains robust and seemingly firm as prior months of tightening in tandem with upsizing seem to have taken quite a bit of excess cash out of the market.

“Lastly, the secondary market is appearing to follow suit, as portfolio rebalancing early in the year is leading to healthy two-way flows between participants.”

Finally, looking ahead from Q2, K2 Advisors remains overweight the insurance-linked securities (ILS) asset class, in conviction terms. In terms of ILS market segments, the firm remains strongly overweight catastrophe bonds, private ILS (so collateralized reinsurance), and retrocession.