Q1’25 insured losses hit $56bn, driven by LA wildfires: Gallagher Re

Reinsurance broker Gallagher Re has estimated that preliminary total insured catastrophe losses for the first quarter of 2025 reached $56 billion, which makes it the costliest first quarter for the private insurance market and government-sponsored insurance entities since 2011, and 176% higher than the Q1 decadal average of $20 billion (2015–2024).

The global wildfire loss tally of more than $40 billion represents not only the most expensive Q1 on record for this peril, but the costliest aggregated quarter or full calendar year wildfire loss for the industry on record, the firm explained.

“The Palisades Fire insured loss estimate (-USD23 billion) by itself is costlier than any other full year of insured wildfires losses on record,” Gallagher Re said.

Moreover, the reinsurance broker also noted that there were only four other global events that drove billion dollar losses for insurers all of which were categorised as US severe convective storms SCS.

This includes the mid-March tornado outbreak ($5.4 billion), a late March US SCS outbreak ($1.2 billion), and a sprawling, mid February storm complex, where SCS losses were the dominant driver ($1.1 billion), along with an SCS outbreak which occurred in early March, ($1.0 billion).

The broker explained that estimates are considered to be preliminary and subject to change.

“The costliest non-US events included Storm Eowyn (which became Ireland’s costliest windstorm on record), the Tainan City Earthquake (Taiwan), and Cyclone Alfred (Australia). Each of those events resulted in insured losses into the hundreds of millions (USD),” the broker said.

Additionally, Gallagher Re noted that beyond the wildfire peril, the only hazard types that saw above average insured losses in the first three months of the year were SCS and tropical cyclone.

The broker explained that global SCS losses in Q1 were $11 billion, and well above the 10-year average.

“Thunderstorms have globally driven more than USD10 billion in Q1 insured losses in five years since 2017 (2017, 2020, 2023, 2024, 2025). The US typically accounts for most of these losses.”

“Q1 losses in 2025 were driven by a series of powerful mid/late March US outbreaks that prompted more than 235 confirmed tornado touchdowns,” the firm added.

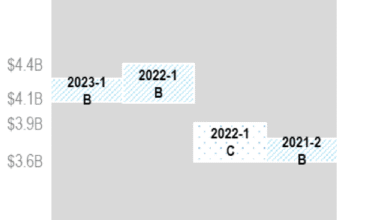

Furthermore, Gallagher Re explained that it was also another season of “largely manageable losses” from the European Windstorm peril.

“The 2024/25 season aggregated to an insured loss of less than USD2.0 billion. Despite being considered a ‘peak’ peril, the European continent has not seen a calendar year industry loss approach USD10 billion since 2007 (driven by Storm Kyrill).”

Lastly, Gallagher Re noted that the United States accounted for more than $52 billion, or 93% of the Q1 insured total.

“This was more than 300% above the region’s decadal average of USD13 billion. It is expected that these Q1 US losses will further increase in the months ahead.

“Every other region of the globe saw below average insured losses. Q1 is not usually a major driver of weather/climate insurance losses; in the past decade it has accounted for just 15% of the annual total.”

Gallagher Re also estimates that the global economic loss total across all natural perils reached $110 billion, which marks the third-costliest Q1 since 2000 and significantly exceeds the recent 10-year Q1 average of $55 billion.

With $110 billion in global economic losses and only $56 billion insured, Gallagher Re’s data clearly highlights a significant protection gap in Q1’25.