Q1 2025 Cat Bonds: Deals upsize 34%, prices settle almost 10% below mid-guidance

During the first-quarter of 2025, the trend in the catastrophe bond market was one of issuances upsizing and pricing down thanks to elevated levels of investor demand and robust capital levels in the sector.

It was a trend that has continued from catastrophe bond market issuance in 2024, when across the full-year positive size changes were seen in every quarter, while two quarters saw negative price moves and the others were barely positive.

Full year 2024 saw the average upsizing across 103 tranches of cat bond notes we have details for increasing by 43%, while spread pricing declined on average -4.6% from mid-guidance.

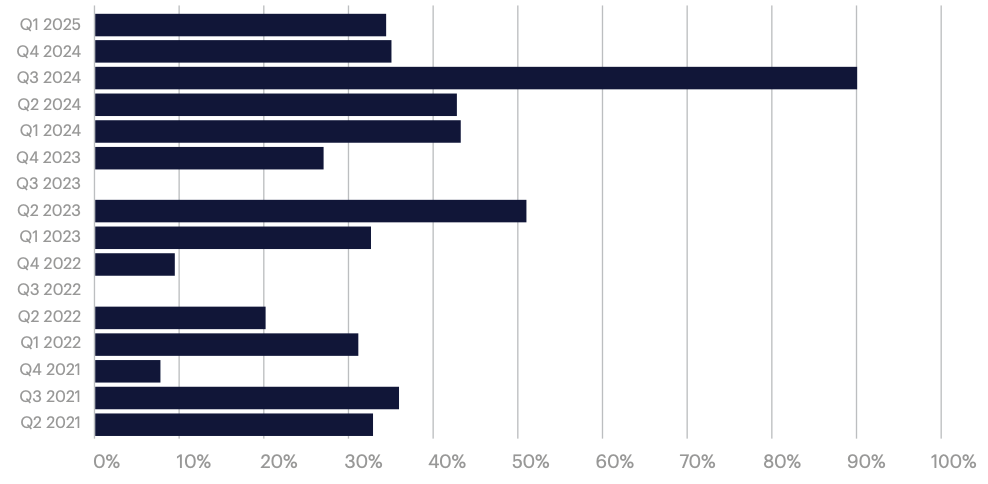

In our latest quarterly catastrophe bond market report, we detail the changes seen in issuance sizes and pricing, showing that on average new cat bond deals upsized by 34% in the first-quarter of 2025.

At the same time, the average price change, from initial marketing to settlement, was a decline of almost -10% from the mid-points of guidance.

Like last year, both investor and sponsor appetite was extremely strong in the first quarter of 2025, as record issuance of $7.1 billion more than offset the almost $4.4 billion of maturities in the period.

What’s more, while marketing, 24 of the 43 tranches of cat bond notes issued that we have data for increased in size, some by 100% or more. In contrast, 18 tranches of notes stayed at their initial size and just one tranche of notes reduced in size while marketing.

All in all, tranches of notes on offer increased in size by an average of 33.6% in Q1 2025, which is in line with Q4 2024 but down on the prior year’s Q1 of 43.3%.

You can see the trend in first-quarter catastrophe bond issuance sizes over their marketing in the chart below:

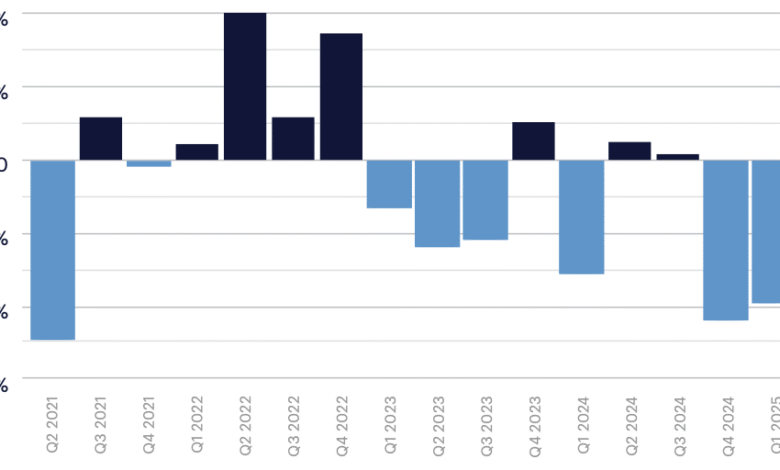

On average, spreads declined from the mid-points of guidance by 9.6% for the tranches of cat bond notes that we have full pricing data for, which is less of a decline than Q4 2024’s 10.8%, and slightly above Q1 2024’s decline of 8.2%.

Of the 43 tranches of notes, 35 saw their spread decline from the mid-point of initial guidance, three priced at the mid-point, and five tranches priced above the mid-point.

Similarly to the previous quarter, sponsors took advantage of strong investor appetite and achieved strong execution on many deals.

You can see the trend in first-quarter catastrophe bond price changes over their marketing in the chart below:

Catastrophe bond issuance sizes and price movements continue to reflect strong market dynamics, with elevated investor demand, high coupon earnings being available for reinvestment and also abundant capital flowing back to be deployed through maturities.

Download your copy of the new Q1 2025 Artemis cat bond market report here.

All of our catastrophe bond market charts and visualisations are up-to-date, so include this latest quarter of issuance data.

We will keep you updated on all catastrophe bond and related ILS transaction issuance as 2025 progresses, and we’ll report on the evolving trends in the cat bond, insurance-linked securities (ILS) and collateralised reinsurance market.

For full details of first-quarter 2025 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

Download your free copy of Artemis’ Q1 2025 Cat Bond & ILS Market Report here.

For copies of all our catastrophe bond market reports, visit our archive page and download them all.