Pre-wind season spreads from early cat bond issuances attract investors

With a growing number of catastrophe bond sponsors opting to bring deals to market earlier in the year, the increasing availability of pre-wind season and off-risk investment opportunities, that pay a partial or full risk premium spread right from settlement, are proving attractive to cat bond investors we’ve spoken with.

For a number of reasons, there have been more US cat bond sponsors, and US-focused named storm-exposed cat bond deals already completed in 2025, which has been one factor helping to bump up 2025 issuance to the record-levels we’ve been reporting on.

The front-loading of the catastrophe bond market pipeline has been a topic of discussion in 2025 so far, as we’ve seen more US hurricane risk transacted in the primary market earlier this year, with questions also raised over whether this could depress Q2 activity levels in return.

One of the reasons for this front-loading of cat bond issuance has been the attractive execution being experienced by sponsors, which began in the final months of 2024 and, given the glut of maturities scheduled, as well as new investors and new capital entering, was always anticipated to continue or even accelerate in 2025.

A second reason for some sponsors coming to the cat bond market earlier in the year than before, is the fact 2024 saw sector capital levels running lower during the peak issuance period of the second-quarter, right in advance of the mid-year renewals. This resulted in less attractive execution for some deals and even some cat bond sponsors going away with less coverage limit secured than they’d originally hoped for.

A final reason, is the fact Q2 can often get congested and as the cat bond market has been growing at an increasing pace, those managing the pipeline (banks and brokers) have been seeking to better time issuances with the availability of capital, bringing more of what a few years ago might have been Q2 cat bonds, into Q1.

Naturally, if a cat bond comes to market in Q1 but the main risk component is not active until late Q2 or into Q3, with the accepted hurricane season start being June 1st but the peak around September time, in order to bring investors to those cat bond deals there needs to be a form of compensation.

Strategies differ here, with these early issued US named storm exposed cat bonds, with some settled early but their risk periods not beginning until June 1st, the start of the Atlantic hurricane season, but others settling early and their risk periods beginning straight away (even though the risk can be low to zero until the season), meaning investors are effectively not shouldering the main risk of the cat bond for a number of months.

Some of these earlier US hurricane exposed cat bonds, whose risk periods are aligned with the start of the season from June, pay investors pre-risk period spreads. So investors earn an amount over and above the collateral return for the period where the notes are off-risk.

Those pre-risk period interest spreads tend to range from 0.5% over the return on collateral, to as high as 2% above, in a number of cases in cat bond deals we’ve tracked this year.

While this can be attractive and certainly is to some, in offering investors a return for the period where the notes are effectively still off-risk, for some cat bond funds and investors these can be less so, given the cost-of-capital their strategies might run with making it feel like assets are stranded and less-productive until the full risk period spread begins.

This year though, we’ve seen more sponsors responding to this.

There have been a number of cat bonds that hold US hurricane exposure, but are issued and settled in some cases as early as in January and February, and their risk periods begin straight away with these issuances paying a full spread above the collateral return to investors right from the start.

Investors we’ve spoken with say these are deemed a particularly attractive option at this stage of the year. In some cases you can benefit from a number of months of full risk interest spread payments at a time of year when there is no hurricane risk at all, or the season has only just begun and risk is still deemed lower.

For a cat bond that settled in Q1 and that paid investors full risk interest spreads from the off, this can mean being compensated for holding the notes without facing what is typically the main source of risk in expected loss terms (for a multi-peril instrument) for that deal, or the only source if it’s a US wind only cat bond.

So it’s no surprise this is deemed attractive and with increasing numbers of cat bonds seeming to pay full spreads from issuance, even some months before hurricane risk is a threat to them, some investors and fund managers have been actively seeking out these deals at primary dealing, although we understand they can be very hard to buy in the secondary market (as you’d expect).

It’s worth also considering the motivations of sponsors to pay this hurricane risk spread before the hurricane season is even a threat to their portfolios.

One motivation would be to perhaps broaden the pool of cat bond fund managers and investors that might look at the sponsors issuance, with some shying away from reduced pre-risk period spread offerings (due to the inability for those returns to cover capital costs in some cases).

Another may be to encourage greater appetite for sponsor’s cat bond issuances, as making them more attractive can help to drive better execution and broader panels.

We also believe investors and fund managers may take into account the potential to earn what can sometimes be seen as a “free spread” for a period of some months and factor it into their view on pricing for a cat bond, which could also enhance deal execution.

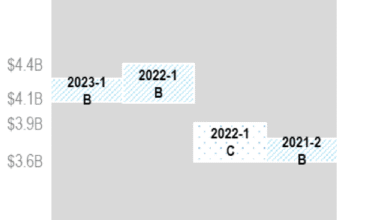

Looking back at our extensive catastrophe bond data, the way cat bonds have executed that offered a full spread from the start, but were partly or fully off-risk due to being pre-wind season, suggests these deals have benefited from larger issuance sizes and reduced pricing in almost every case. This might indicate these pre-wind season spreads could be a beneficial lever for cat bond sponsors to encourage stronger execution from the market.

We suspect these features will remain and perhaps become even more prevalent, as it ensures investors feel well-compensated for buying into a new catastrophe bond deal well before the main peril exposure comes on-risk, but importantly also gives the sponsor an additional way to generate more investors support and strengthen price execution for its cat bond issues as well.