Louisiana Citizens secures its largest cat bond, 40% upsized $280m Bayou Re 2025-1

Louisiana Citizens Property Insurance Corporation has secured the 40% upsized target for $280 million of collateralized named storm reinsurance from the Bayou Re Ltd. (Series 2025-1) catastrophe bond issuance, which now becomes the insurers largest cat bond ever, Artemis can report.

It only beats last years Bayou Re 2024-1 cat bond for size by $5 million, but given the multi-peril nature of cat bond coverage, Louisiana Citizens has significantly expanded the capital markets share of its reinsurance tower over the last few years.

At first, , Louisiana Citizens had been targeting $200 million of collateralized named storm reinsurance protection from its latest cat bond.

We then learned from sources that the target size had been increased by 40% to $280 million, while at the same time the price guidance was lowered.

Now, we’re told the upsized target of $280 million was achieved, as the Bayou Re 2025-1 cat bond notes eventually priced below their initial guidance range.

So, this new deal becomes the third cat bond issued by the Bayou Re Ltd. special purpose insurer (SPI) in Bermuda, further building-out Louisiana Citizens multi-year hurricane and named storm reinsurance protection with the support of capital market investors.

Bayou Re Ltd. will now proceed to sell investors a $280 million single Class A tranche of Series 2025-1 notes, with the proceeds used to collateralize a reinsurance agreement between the SPI issuer and Louisiana Citizens.

Structured to provide indemnity triggered protection on a per-occurrence basis, across a three-year term, the cat bond notes expand Louisiana Citizens sources of reinsurance coverage against losses from named storms in the state.

The Series 2025-1 Class A notes Bayou Re Ltd. come with an initial attachment probability of 1.93%, an initial base expected loss of 1.69% and were initially being offered to cat bond funds and investors with spread price guidance in a range from 7.5% to 8%.

As we then reported, the spread guidance was tightened and the notes offered to investors with a spread range of 7% to 7.5%, so falling below the initial spread guidance.

Now, we’re told the notes have been priced to pay investors a spread of 7%, so the low-end of reduced guidance and representing a roughly 10% drop in price from the mid-point of initial guidance.

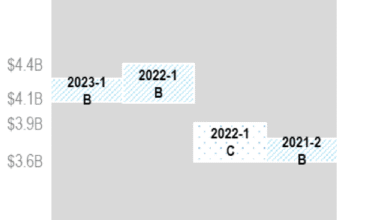

It’s another strong result for Louisiana Citizens in the cat bond market and with the $175 million Catahoula II Re 2022-1 cat bond maturing this year, it means LA Citizens will enter the hurricane season with more catastrophe bond backed reinsurance than a year ago.

You can read all about this new Bayou Re Ltd. (Series 2025-1) catastrophe bond and every other cat bond issued in the extensive Artemis Deal Directory.