Great American secures $310m Riverfront Re 2025 cat bond, its largest yet

Great American Insurance Group has now secured $310 million of multi-peril collateralized reinsurance through its new Riverfront Re Ltd. (Series 2025-1) catastrophe bond transaction, which represents 38% more in protection than the insurer had initially targeted from the deal and its largest cat bond yet, according to our sources.

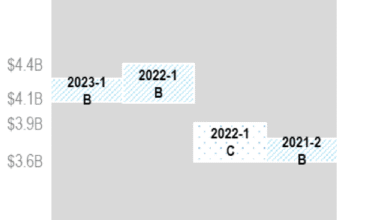

Great American Insurance Group was last in the cat bond market in 2021, when it sponsored a $305 million Riverfront Re 2021-1 deal, prior to which the insurer had sponsored a $190 million Riverfront Re 2017-1 cat bond and its debut issuance was a $95 million Riverfront Re 2014-1.

Read about all of Great American Insurance Group’s catastrophe bonds in our extensive Deal Directory.

From the initial target for $225 million of reinsurance, as we reported, an update to this Riverfront Re 2025-1 cat bond issuance saw Great American lifting the target size to between $300 million and as much as $350 million of protection.

Now we are told that the Riverfront Re 2025-1 cat bond notes have been priced to lock-in $310 million in reinsurance for Great American Insurance Group, so an upsizing of almost 38% and making this the largest cat bond the company has ever sponsored.

The $305 million Riverfront Re 2021-1 catastrophe bond had matured at the end of 2024, so this new deal replaces and adds an additional $5 million to the capital markets backed reinsurance the insurer benefits from with its catastrophe bonds.

Now finalised, this Riverfront Re 2025-1 cat bond issuance will provide Great American Insurance with $310 million of multi-year and multi-peril collateralized reinsurance protection over a three and a half year term, to end of December 2028, so providing four seasons of hurricane coverage as well as protection for other perils.

The covered perils are U.S., DC and Canada named storms, earthquakes, severe thunderstorms, winter storms, wildfires, meteorite impact, and volcanic eruption, all on a per-occurrence and indemnity trigger basis.

What was originally a $150 million tranche of Class A notes have now been finalised at $200 million in size, so one-third bigger.

The Class A notes come with an initial expected loss of 0.56% and were first offered to cat bond investors with price guidance of 4.75% to 5.75%. The pricing has now been finalised at 5.5%, so roughly 5% above the mid-point of initial guidance.

What was a $75 million Class B tranche of notes have now been finalised to provide $110 million of reinsurance protection, so a roughly 47% upsizing.

The Class B notes have an initial expected loss of 1.54% and were first being offered to cat bond investors with price guidance of 7.5% to 8.5%. These notes have now been priced to pay investors a spread of 7.75%, which is around 3% below the mid-point of the initial guidance.

So, it’s good to see Great American Insurance Group maintaining and slightly upsizing its use of catastrophe bonds as part of its reinsurance tower, while the mixed trajectory of pricing for the spreads of each tranche of notes also shows investors remaining discerning and demanding adequate risk-adjusted returns.

You can read all about this new Riverfront Re Ltd. (Series 2025-1) catastrophe bond and hundreds of other cat bonds in the extensive Artemis Deal Directory.