Cyber cat bonds may outperform on major loss reinsurance recoveries, Howden Re data shows

Analysis from reinsurance broker Howden Re suggests that a cyber catastrophe industry loss event of $9 billion or more would result in more meaningful losses to the outstanding cyber cat bond market, and that cat bond may outperform on a recovery basis for cedents.

In a new recent paper, Howden Re looked at the robustness of the cyber reinsurance market and the range of instruments available to cedents.

The broker found that under certain analyses, the data suggests that reinsurance may not be working as efficiently in the cyber ecosystem as expected, with even relatively extreme cyber cat loss scenarios only resulting in cedents recovering a relatively small amount of their purchased limit.

Within the range of cyber reinsurance tools available, the catastrophe bond and industry-loss warranty (ILW) are two backed by the capital markets.

The data also handily shows where the catastrophe bond market should begin to worry, should a major cyber loss event occur.

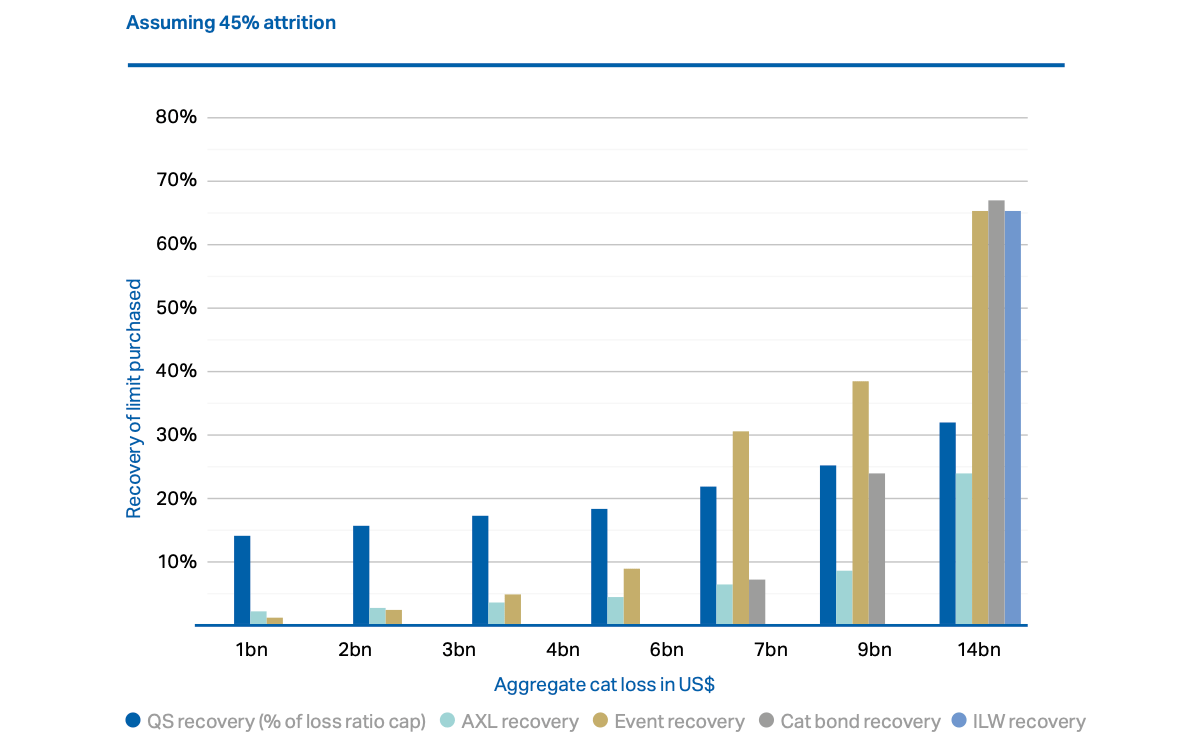

Assuming a relatively stable attritional loss environment, Howden Re’s analysis shows that catastrophe bond losses wouldn’t begin until a $7 billion or greater cyber cat loss event hit the insurance industry, when less than 10% of cyber cat bond limit would be recovered.

Things step up at a $9 billion cyber industry loss event, when around 23% of cyber cat bond limit might be recovered by cedents, while a $14 billion event could see around 67% of cyber cat bond limit being recovered by deal sponsors.

Interestingly, Howden Re highlights that some reinsurance tools in the cyber protection kit may not work as anticipated should a major cyber catastrophe loss event occur.

“Through this lens alone, reinsurance may not be working as efficiently in the cyber ecosystem as expected. Figure 8 illustrates that insurers recover only a small percentage of their purchased limit, even in extreme loss scenarios where full, or near full, recoveries would be anticipated. For example, at a US$ 9 billion dollar cat loss, insurers only recover ca. 10% of their aggregate excess-of-loss (AXL) cover in a stable attrition environment,” the reinsurance broker explained.

As you can see in the image above though, catastrophe bonds do appear to be working as designed, in not triggering until a larger loss occurs, but then delivering more limit benefits back to cedents for a $9 billion loss than agg XL coverage and for a $14 billion loss delivering the greatest percentage of reinsurance limit benefit back of any protection tool.

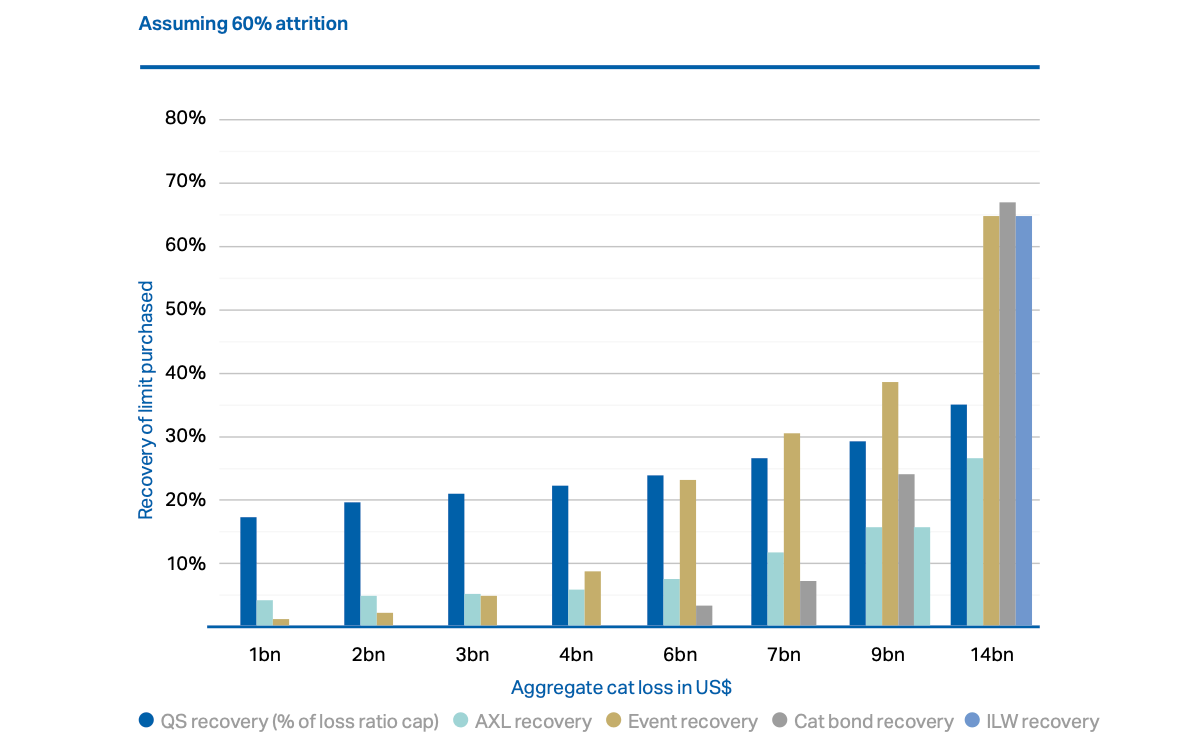

Under a more severe attrition year scenario, seen below, Howden Re’s analysis shows that cyber cat bond coverage may begin to pay-out slightly earlier, with a small amount of recoveries after a $6 billion cyber industry loss.

But through the higher loss events the same kind of percent of limit payouts would come due, with cat bonds again offering a bigger percentage reinsurance recovery for the largest cyber catastrophe events it seems.

It’s important to note that the analysis is just one way of looking at the data, but it does suggest that for large cyber catastrophe loss events the cat bond structure can provide valuable protection, that may pay-out effectively for cedents in limit percentage terms.

Perhaps notably, the cyber industry-loss warranty (ILW) pays out only at the highest-level of catastrophe loss under Howden Re’s analysis, suggesting the instruments in the market so far have relatively high loss triggers set.

Howden Re’s analysis indicates cyber catastrophe bonds would work as sponsors should expect, triggering under the more severe catastrophe loss scenarios and then providing meaningful reinsurance recovery benefits as the size of an industry loss event rises.

You can download a copy of the full report from Howden Re here.

Also read: Cyber retro must be structured to attract capital markets at scale: Howden Re.