City of Zurich Pension gets 9.2% return from ILS, allocates to Tangency Capital & Integral

The City of Zurich Pension Fund has continued to expand its activities as an investor in insurance-linked securities (ILS), growing the size of its investment to now in excess of US $1.15 billion, while adding new allocations to ILS managers Integral ILS and Tangency Capital in the last year.

At the time, the Zurich Pension Fund (or Pensionskasse Stadt Zürich) had mandates in place with eight investment managers across life and P&C reinsurance investments.

Now, the number of mandated managers has been lifted to ten, with new allocations to privater reinsurance focused ILS funds managed by specialists Integral ILS and Tangency Capital.

Tangency Capital, the quota share focused ILS investment manager, was added in May 2024, while Integral ILS was added in December, disclosures from the pension show.

The City of Zurich Pension Fund has been investing in insurance-linked securities (ILS) since 2017.

It began by allocating to life settlement allocations with Broadriver and Miravast, before adding its first P&C ILS fund allocation to Elementum Advisors in June 2019, after which an allocation to a SCOR Investment Partners ILS strategy was added in January 2021.

Allocations to ILS strategies managed by Schroders, Pillar Capital and RenaissanceRe at the end of 2021. Then at the end of 2022, the pension added new allocations to life insurance-linked investment strategies managed by Broadriver and Miravast, and finally it made an allocation to a fund managed by Hiscox ILS in September 2023.

Now, with the addition of first Tangency Capital and then Integral ILS, the pension fund has clearly demonstrated its desire to grow into the asset class, and it has room to do so.

As of March 2025, the allocation stood at 4.9% of assets, which based on just over 21 billion Swiss Francs roughly works out to be around US $1.15 billion at the last reporting date.

But, 4.9% of overall assets is still slightly under the optimal strategic allocation target of 5% for the ILS asset class, according to the pension, within a target range of a minimum allocation of 2.5% and maximum allocation of 8%.

So, should the City of Zurich Pension Fund elect to, it has the ability to deploy as much as perhaps US $1.9 billion into insurance-linked securities, property & casualty or life related.

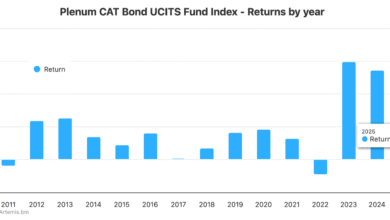

The ILS investments have been performing as planned again in the last year, with the City of Zurich Pension Fund reporting that they delivered a 9.2% return in the last financial year.

Calling this a “pleasing contribution” the pension fund also noted that this was the same return as the benchmark it uses for its range of insurance and reinsurance linked investments.

Insurance-linked securities (ILS) beat many other asset classes for the pension in the last year, with the return of its ILS investments only falling behind major and emerging market equities, while beating broader hedge fund strategies, infrastructure, private equity and real estate.

Overall the City of Zurich Pension Fund’s portfolio delivered a 7.5% return in the last year, meaning the ILS allocation was a positive contributor that raised total returns for the pension once again.

View details of major pension fund and sovereign wealth investors in ILS and reinsurance in our directory.