Catastrophe bonds could make-up 70% of Florida Citizens reinsurance in 2025

With Florida’s Citizens Property Insurance Corporation now aiming to upsize its new catastrophe bond issuance to between $1.4 billion and a record $1.525 billion in size, while its overall target for reinsurance has fallen slightly to $4.49 billion, once in-force cat bonds are added to the new issuance, the cat bond market could make up roughly 70% of its risk transfer in 2025.

Now, in the latest disclosure from Citizens, the target for total risk transfer limit for 2025 has declined slightly to $4.49 billion, meaning that only $2.89 billion of new reinsurance and/or cat bonds are required.

As we have explained, Citizens has $1.6 billion of outstanding multi-year catastrophe bond limit that will remain in-force through the 2025 hurricane season, so with the new $4.49 billion risk transfer target that was discussed at a Board meeting yesterday, that leaves the $2.89 billion target for new limit for this year.

Now, as we reported this morning, Florida Citizens has a new catastrophe bond in the market and has lifted the target size for the Everglades Re II Ltd. (Series 2025-1) to between $1.4 billion and as much as $1.525 billion, having initially aimed for at least $975 million of reinsurance limit from the deal.

Should the new Everglades Re II 2025-1 cat bond settle at the higher-end of that size range, to provide $1.525 billion of multi-year reinsurance, it would mean Florida Citizens has $3.125 billion of cat bond limit outstanding for the 2025 wind season, which we believe is the highest ever level for the insurer.

It’s also notable that at $1.4 billion or above the new cat bond will be at least the joint second-largest ever issued, but if it achieves the new $1.525 billion upper-target is will become the largest cat bond we’ve ever seen.

The slight reduction in risk transfer limit needed for 2025 has come due to some adjustments to the proposed risk transfer tower Florida Citizens has been designing with the assistance of its reinsurance brokers.

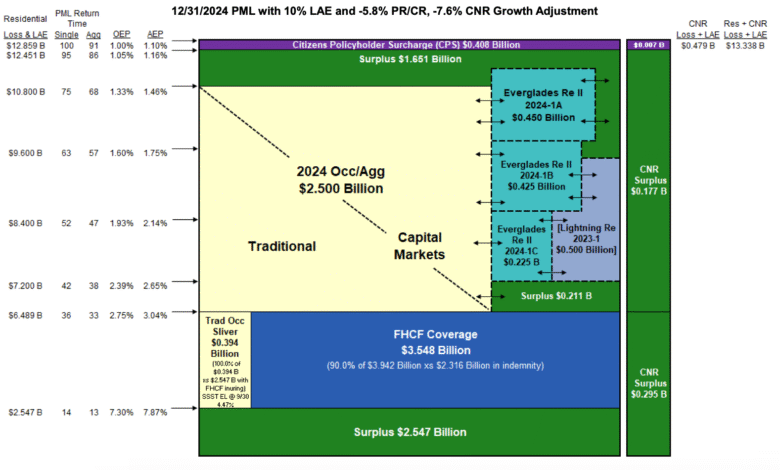

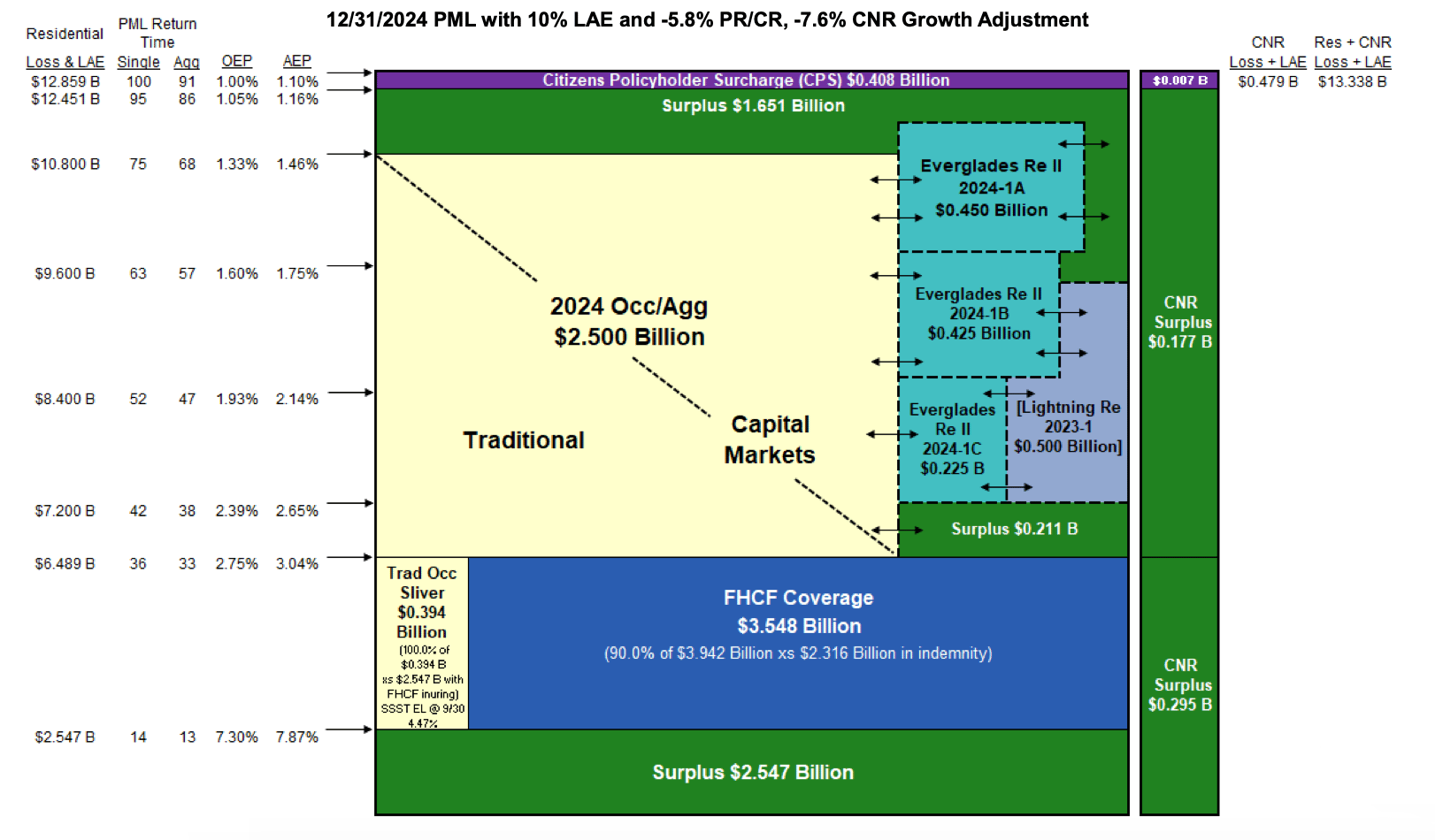

This has occurred due to changes to where surplus sits in the tower and reduced policyholder surcharge at the top of the tower, resulting in the slight $50 million decrease in risk transfer requirements from the private market. However, the tower itself still extends to $12.859 billion of losses and loss adjustment expenses at the 1-in-100 year PML top level.

You can see the tower that was proposed back in March in our previous article here.

The new preliminary layer chart for the Florida Citizens risk transfer tower can be seen below:

Finally, it’s interesting to note that budget expectations have changed, as previously in our March article we had explained that Florida Citizens had said it was budgeting for approximately $650 million of premiums to secure the necessary risk transfer and reinsurance protection for 2025.

Now, at a Board meeting held yesterday, Citizens staff said they would aim to secure the proposed risk transfer, reinsurance and cat bond tower for budgeted premiums of approximately $550 million and were prepared to set that as a top amount to spend for 2025.

It’s worth remembering that within that budget are the premiums required for the still in-force multi-year cat bonds, as well as any new protection Citizens purchases in 2025.

As we’ve explained before, the decline in projections for premiums to be ceded has come with the reduction in exposure Florida Citizens has experienced, as its depopulation program has taken greater effect in the last year.

But, we suspect there is also an allowance for softer pricing in the property catastrophe reinsurance space, as well as softer pricing in the catastrophe bond market, which may help Citizens reign in some of its risk transfer expenses while still meeting its protection goals in 2025.

The Board approved the motion to go to market and attempt to procure the necessary reinsurance and catastrophe bonds to achieve the targeted funding levels for 2025, for the budgeted $550 million of premiums amount.

We’ll update you as and when information emerges on purchases made and the final size and pricing for the new Everglades Re II Ltd. (Series 2025-1) catastrophe bond.