Catastrophe bond issuance already on-track to surpass record for first five months

Even with a few days to run of the fourth month of the year, catastrophe bond market issuance in 2025 is already on-track to set a new record for issuance through May, as the pipeline of new cat bond deals continues to build.

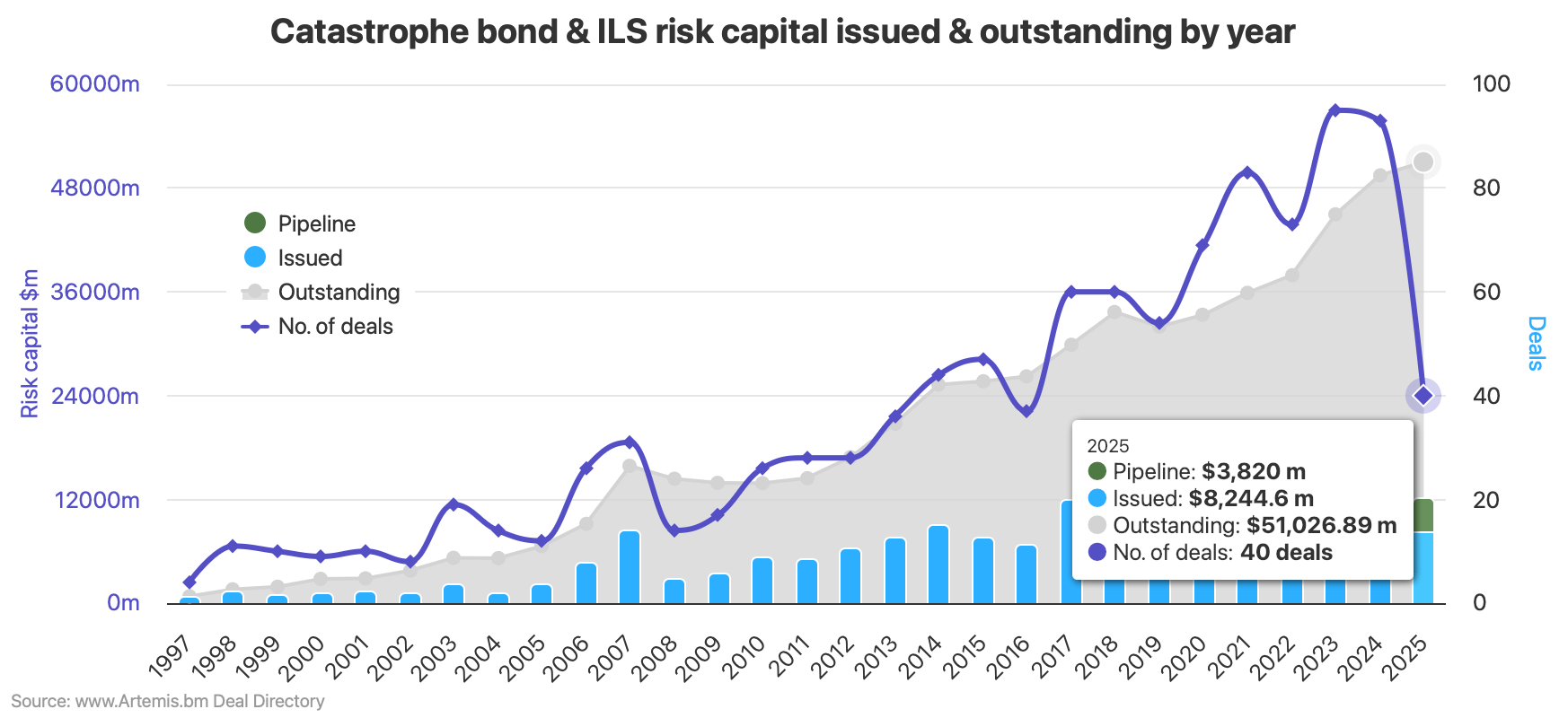

With new catastrophe bond issuances that have completed and settled this week, the total cat bond issuance tracked in the Artemis Deal Directory has already reached almost $8.25 billion this year.

But, impressively, the pipeline of new cat bonds slated for completion and settlement up to and including the month of May so far has now reached $3.82 billion.

As a result, our forecast for catastrophe bond issuance across Rule 144A cat bonds and the privately placed deals we’ve tracked so far in 2025 has now reached $12.07 billion, with all of that issuance currently scheduled to settle by the end of the week of May 19th at this stage.

Analyse catastrophe bond issuance and the size of the market by risk capital outstanding by year in this chart, which also shows the current cat bond pipeline of deals in the market but yet to settle.

The use of catastrophe bonds as a mechanism to access institutional investor supplied capacity continues to accelerate in 2025.

Increasingly, insurance and reinsurance companies are sponsoring catastrophe bonds to access efficient fully-collateralized reinsurance and retrocession from the capital markets.

The market has been setting records through many months of the year so far.

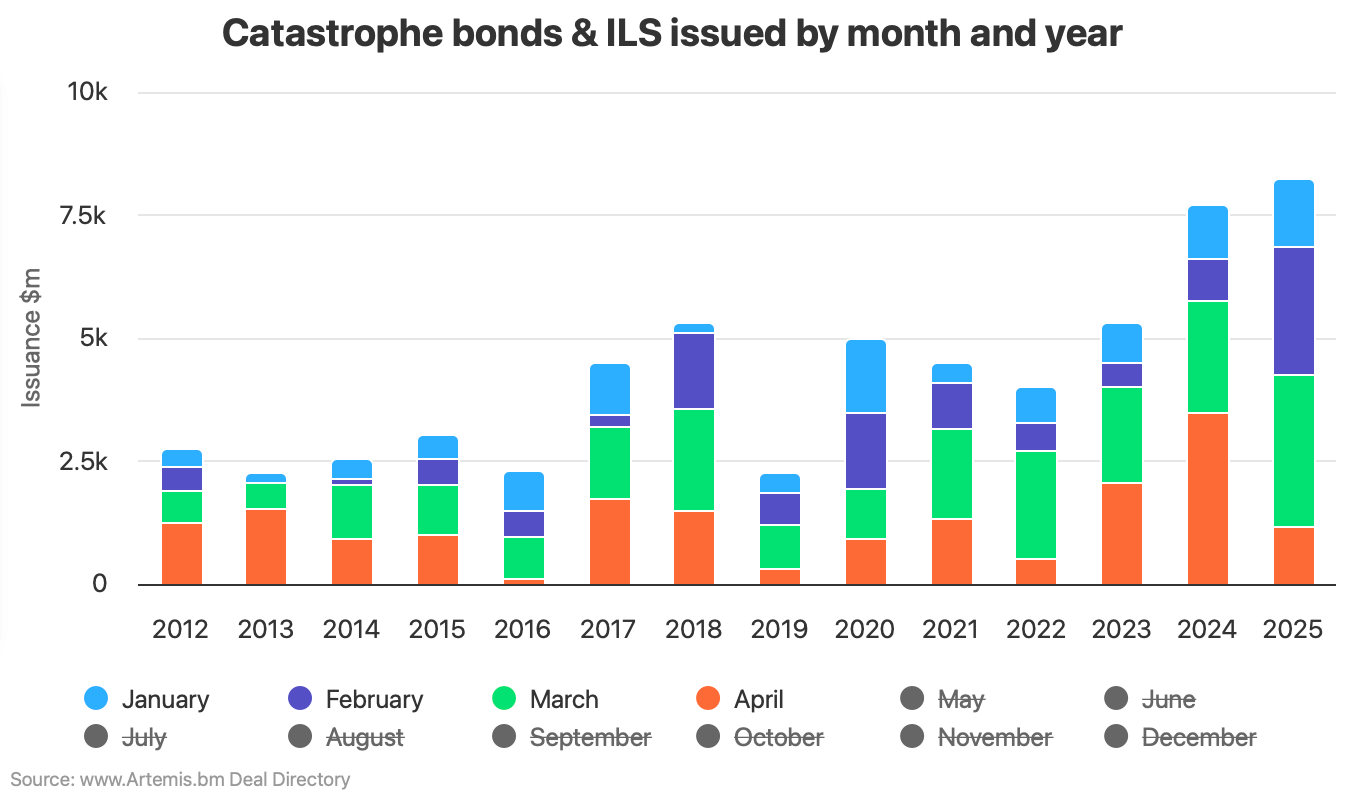

January 2025 did not set a record in its own right, but at over $1.41 billion it was the second highest cat bond issuance for that month ever.

February 2025 then set a significant record, as cat bond issuance reached almost $2.59 billion, which was almost double the previous record set in Feb 2020 of $1.55 billion.

March 2025 then also set a new record for cat bond issuance in the month at almost $3.08 billion.

April 2025, which is still not over, now sees completed cat bond issuance for the month standing at $1.17 billion, but with a further $1.71 billion targeted in the pipeline and slated to settle before the end of the month, which could take total April 2025 cat bond issuance to $2.88 billion. While not a record for April, this month will be the second biggest on-record after last year’s bumper $3.47 billion April 2024.

The pipeline for May is also building nicely, with currently as much as $2.11 billion of cat bond issuance targeted for settlement during the month. There will be a way to go to beat last year’s over $4 billion, but there is plenty of time left for more new deals to surface for issuance during May.

Looking at the run-rate across months, the catastrophe bond market in 2025 has so far set new issuance records for the first-two, three and four months of the year.

The chart below shows issuance to-date, versus the first-four months of prior years. Remember you can select and deselect months at the bottom of the chart to analyse issuance by period using the interactive version here.

Adding in the pipeline of deals slated for settlement in May and we can already see that catastrophe bond issuance in 2025 is now set to break the record for the first five months as well, at $12.07 billion, soundly beating already last year’s January to May 2024 cat bond issuance of $11.72 billion.

It’s not just the accelerating pace of catastrophe bond issuance that is impressive in 2025, so too is the expansion of the cat bond market sponsor-base.

The number of first-time sponsors in the market so far in 2025 has now reached double-digits, with ten new ceding company names detailed in catastrophe bond transactions we’ve analysed so far.

That’s a new record for first-time cat bond sponsor names in the first-half of the year already, beating the nine debut cat bond sponsors seen in H1 2024.

Right now, it looks like Q2 2025 will feature the most new cat bond sponsors of any quarter in the market’s history.

That’s testament to the growing popularity of catastrophe bonds as a form of reinsurance and risk transfer, as well as to the hard work of broker teams in promoting cat bonds as an efficient source of risk capital, and to the growth on the investor side as well led by the dedicated cat bond fund managers.

All in, 2025 so far has been banner year for the catastrophe bond market, with numerous records being set and market expansion accelerating.

At this time, Artemis’ measure for the size of the catastrophe bond market, by risk capital outstanding, sits at just over $51 billion.

Still to come in the second-quarter are a further $3.58 billion of cat bond maturities.

But with the pipeline for the quarter already standing at $3.82 billion further outstanding cat bond market growth is already baked in before the middle of the year. The only question is just how much growth we will see, given there is still plenty of time for more of the pipeline cat bonds to upsize and for new issues to emerge for settlement through May and into June.

The catastrophe bond market loos destined to end the first-half of 2025 with a new record for H1 issuance, a new record for the size of the outstanding cat bond market and a new record for the number of new sponsors to enter the space during the six month period.

Which sets the cat bond sector up for a good chance of breaking full-year records as well, should issuance continue at its currently elevated pace.

Stay tuned to Artemis for critical catastrophe bond market insights as the rest of 2025 progresses!

Don’t forget, you can track catastrophe bond issuance and the pipeline of deals due to settle in this chart.

You can track settled cat bond issuance by month and quarter in this chart (use the key of months at the bottom to include and exclude any from your analysis).

The Artemis Deal Directory lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s. The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list.

Analyse the catastrophe bond market using our charts and visualisations, which are kept up-to-date as every new transaction settles.

Download our free quarterly catastrophe bond market reports.

We track catastrophe bond and related ILS issuance data, the most prolific sponsors in the market, most active structuring and bookrunning banks and brokers, which risk modellers feature in cat bonds most frequently, plus much more.

Find all of our charts and data here, or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.

All of these charts and visualisations are updated as soon as a new cat bond issuance is completed, or as older issuances mature.

All of our catastrophe bond market charts and visualisations are up-to-date and include data on new cat bond transactions as they settle.