Cat bond market repriced to lower margin: Arch CEO

Arch Capital Group CEO Nicolas Papadopoulo says downward repricing in the catastrophe bond market is creating pressure at the top of reinsurance programs, even as structural supply constraints in peak zones like Florida could temper broader softening across the mid-year renewals.

Earlier today, executives from the firm held an earnings call with analysts, during which the mid-year renewals, and the Florida market, were discussed.

With demand increasing for property catastrophe reinsurance coverage, notably in regions such as Florida and the Gulf Coast, Papadopoulo warned that meaningful additional capacity remains difficult to source.

CEO Papadopoulo said in his opening remarks: “As we look towards mid-year renewals, particularly with coverage in Florida and the Gulf, we expect additional demand from existing and new clients.

“On the supply side, it is worth noting that for many reinsurers and the ILS funds, this zone represents peak exposure. As a result, significant additional capacity may be harder to come by, even if the market is more competitive on the margin.”

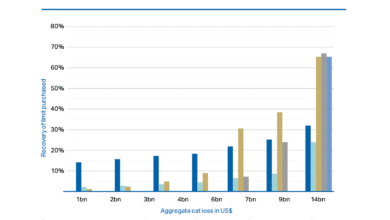

The CEO explained that the most noticeable pricing shifts are occurring at the top of the reinsurance tower, where catastrophe bond returns have been compressed due to strong recent performance and growing investor participation across the market.

“We’ve seen the cat bond market being repriced to lower margin, so I think that puts pressure also to the layer below the cat bond market.”

While upper layers have largely been free of losses, the lower end of programs has absorbed claims from recent events such as California wildfires and storm activity.

“Obviously there hasn’t been any losses on those layers where at the bottom of the program, between the California wildfire on the Nationwide account, and some of the storms that we’ve seen, we have had losses.

“I would say the place where price decrease seems to be focusing is really at the top of the program,” the CEO added.

Furthermore, Papadopoulo added that regional differences remain important.

“Florida is going to be more complicated, because I think again there’s not that much supply in the marketplace. So I would expect it to maybe not be as strong as in the Northeast region, where you haven’t had a loss in any of the top layers, or mid-to-top layers for a long time, and people see that.”

The CEO concluded by reiterating that pricing pressure is most evident at the top of programs, with more moderate changes expected further down.

“If something is going to happen, in my view, it’s probably more pressure on the top of the program and maybe less, more moderate pressure on the bottom.”