California wildfires drive Q1 insured cat losses of at least $53bn: Aon

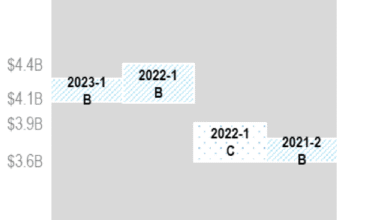

According to broker Aon’s Q1 Global Catastrophe Recap, insured losses in the opening quarter of 2025 exceeded $53 billion, well above the 21st-century Q1 average of $17 billion, marking the second-highest total on record after Q1 2011.

At the same time, Q1’25 economic losses were at least $83 billion, which, according to the firm was well above the 21st-century Q1 average of $61 billion.

Much of these losses were again driven by the California wildfires, as Aon explained: “The Palisades and Eaton Fires were by far the costliest events of the first quarter of 2025. California wildfires damaged or destroyed more than 18,000 structures and became one of the costliest wildfires on record globally.”

The firm continued: “At least seven other events resulted in economic losses above the billion-dollar mark. This includes multiple SCS outbreaks in the United States in February and March, the Tibetan Plateau earthquake in January, and a deadly earthquake in Myanmar and Thailand, where the impacts are still being assessed.”

Aon further noted that economic losses in the U.S. alone reached nearly $71 billion in Q1, its highest level since 1994 and well above the post-2000 Q1 average of $12 billion.

“In contrast, Q1 economic losses in all other regions were below their long-term Q1 averages,” Aon added.

Considering these numbers, Aon suggested that there stands an insurance protection gap of 36%, the lowest Q1 value since 1990 (47%).

The broker stated that this was predominantly due to high insurance penetration in the United States, where the majority of the losses occurred.

Michal Lörinc, head of catastrophe insight at Aon, commented: “The economic uncertainty presented by natural catastrophes, such as the devastating wildfires in California and the deadly earthquakes in Myanmar, underscores the critical need for comprehensive risk management strategies.”

Adding: “At Aon, we are committed to providing data-led insights and next-generation analytical tools that empower both the public and private sectors to better prepare for and mitigate the impacts of these disasters. By leveraging our expertise in catastrophe analytics, we help our clients make informed decisions that enhance resilience and reduce volatility across their portfolios.”