Allstate expects $123m reinsurance recovery from its aggregate cat bonds

US primary insurer Allstate has disclosed that a heavy March catastrophe loss burden means it now anticipates making $123 million of reinsurance recoveries from its aggregate tower, whose coverage is solely provided by catastrophe bonds from the Sanders Re program.

The insurer said that the catastrophe losses came from 11 events during the month of March, with approximately 80% related to four geographically widespread wind and hail events.

In light of the heavy March catastrophe loss load, the insurer said, “In March, Allstate surpassed the retention level of the annual aggregate reinsurance cover for the annual risk period ending March 31, 2025, with expected recoveries of approximately $123 million, reducing March catastrophe losses.”

Allstate’s annual aggregate reinsurance protection is solely provided by a number of outstanding tranches of its Sanders Re catastrophe bonds, meaning cat bond investors appear set to face reductions in principal perhaps across two tranches of these notes.

It’s worth noting before we go into the details that, after Allstate reported a relatively low catastrophe loss burden for February 2025, investors we’d spoken with were hopeful that the aggregate Sanders cat bonds could make it to the end of their annual risk period without attaching.

Remember that Allstate’s annual risk period for its aggregate reinsurance, which is all multi-year and cat bond based, runs from April 1st to March 31st each year.

As we also reported last week, despite its price having recovered back almost to par across catastrophe bond pricing sheets in recent weeks, one of Allstate’s cat bond tranches that provides aggregate reinsurance and had been scheduled to mature, has seen its maturity date extended by three years.

So, having just a month ago thought these cat bonds were looking safer, which resulted in them being marked up in some broker pricing sheets during March, it now transpires that Allstate’s March catastrophe losses have been sufficiently severe to see its annual aggregate loss total breach the attachment points.

As a result the extension of maturity proves warranted, although the marking back to near-par perhaps a little hopeful with the benefit of hindsight.

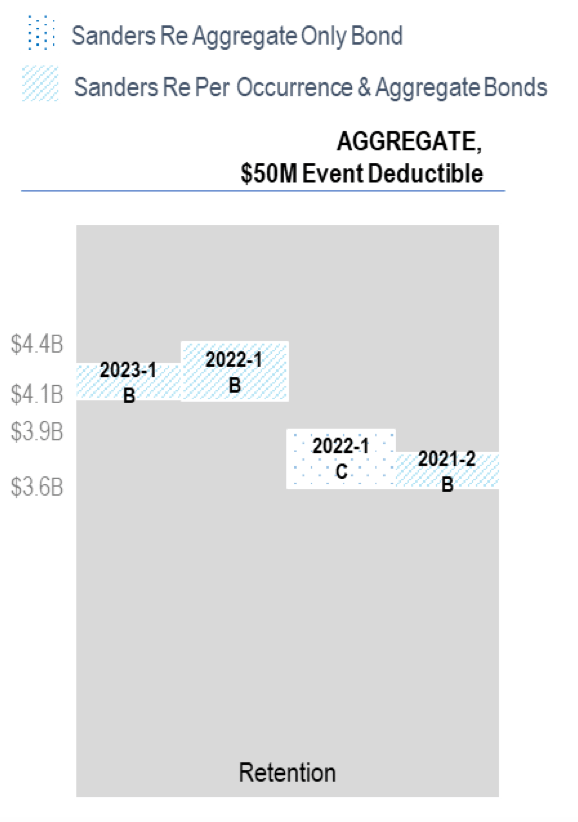

However, with $50 million event deductibles in place for the agg cat bond tranches, not all of that qualifies.

But, we know the attachment for the lowest two aggregate cat bond tranches sits at $3.6 billion of qualifying losses, so with a $123 million recovery anticipated by Allstate it seems the relevant reported figure must be around $3.723 billion at March 31st.

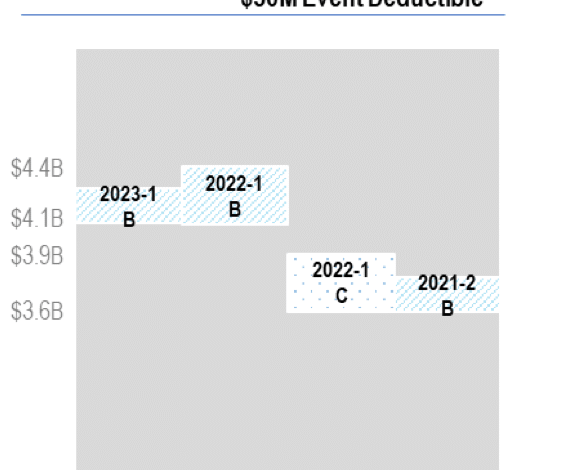

You can see Allstate’s aggregate reinsurance tower to the right, not to scale, which shows that the two lower-layer catastrophe bonds both attach at the same $3.6 billion level.

The $150 million Class B tranche of notes from the Sanders Re II Ltd. (Series 2021-2) issuance are the ones which have been extended, while the other $175 million Class C tranche of notes from the Sanders Re III Ltd. (Series 2022-1) issuance remain on-risk.

Given how these sit in the tower, its seems they would likely face an even share of the total reinsurance recovery that Allstate is able to make under the aggregate contract terms.

So, with Allstate currently estimating a $123 million reinsurance recovery is due from its aggregate cover provided by these cat bonds, right now it appears they would face 50% each.

It is worth remembering that one qualifying event for these aggregate cat bonds from the last risk period was the LA wildfires in California and so if there is a successful subrogation claim and recovery made, that could have some effect on these cat bonds and we’ve seen before recoveries being repaid to investors after previous wildfire subrogation events.

But, at this time, there’s no certainty regarding subrogation, so investors will need to mark their holdings in these notes accordingly for now.