Best of Artemis, week ending May 11th 2025

Here are the ten most popular news articles, week ending May 11th 2025, covering catastrophe bonds, ILS, reinsurance capital and related risk transfer topics. To ensure you never miss a thing subscribe to the weekly Artemis email newsletter updates or get our email alerts for every article we publish.

Ten most read articles on Artemis.bm, week ending May 11th 2025:

- Florida Citizens secures the biggest catastrophe bond ever, $1.525bn Everglades Re II

Florida’s Citizens Property Insurance Corporation has now successfully priced what is the biggest catastrophe bond issuance ever seen, securing a 56% upsized $1.525 billion of reinsurance from its new Everglades Re II Ltd. (Series 2025-1) issuance. - Zurich buys “innovative” global aggregate reinsurance, including collateralized capacity

Zurich took advantage of market conditions to buy a global aggregate reinsurance cover at the April 1st renewal, which the firm’s CFO called “innovative” and said it included alternative capacity from collateralized markets. - GAM Star Cat Bond Fund loses 25% of assets in April, AUM declines by ~$650m

The GAM Star Cat Bond Fund strategy has experienced a meaningful outflow of investor capital we understand, with the UCITS fund’s assets under management declining by approximately 25%, or around US $650 million, just in the month of April 2025. - Fermat to become sole manager of offshore GAM FCM Cat Bond Fund

GAM Investments (GAM) and Fermat Capital Management (Fermat) said that they have reached a mutual agreement that will see Fermat becoming the sole manager of the offshore GAM FCM Cat Bond Fund, with GAM to have no ongoing involvement in the strategy. - Reinsurance pricing back at 2023 levels, says JPM. Cat bonds may be back at 2022

Analysts at J.P. Morgan believe that reinsurance pricing has reverted back to 2023 levels, which was the beginning of recent market hardening. Data suggests the catastrophe bond market has softened a little more, or ahead of the traditional market’s pace, being closer to 2022 levels at this time. - Twelve Securis limits new subscriptions to flagship cat bond fund to maintain integrity as it grows

Twelve Securis has put in place a temporary restriction on new subscriptions to its flagship Twelve Cat Bond Fund, as the manager looks to manage flows as the strategy reaches a new record size. - USAA secures $425m aggregate reinsurance from new Residential Re 2025-1 cat bond

USAA has now secured the upsized target for $425 million of multi-peril aggregate reinsurance protection from its latest catastrophe, with the new Residential Reinsurance 2025 Limited (Series 2025-1) deal now priced within the initial guidance. - Amanda Lyons promoted to CEO of Aon Reinsurance Solutions in Bermuda

Aon has promoted long-standing senior employee Amanda Lyons to Chief Executive Officer (CEO) of its Reinsurance Solutions unit in Bermuda, effective July 1st, subject to regulatory and immigration approvals. - Catastrophe bonds widen in April as seasonality lifts market yield back to 10.86%

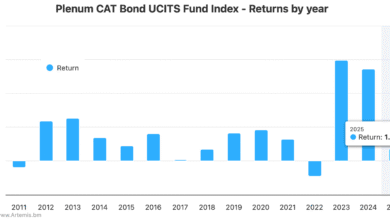

Having competed with demand for a couple of months, seasonality seemingly took over in the catastrophe bond market in April 2025, as spread widening returned and lifted the overall yield of the catastrophe bond market to 10.86% by May 2nd, according to the latest data from Plenum Investments. - ILS an increasingly viable reinsurance alternative, continued growth expected: Gallagher Securities

The insurance-linked securities (ILS) market is gaining ground as a viable reinsurance alternative, helped by reduced risk premiums, increased confidence in models, lower transaction costs and still-growing investor interest, leading Gallagher Securities to say it anticipates continued growth of the sector.

This is not every article published on Artemis during the last week, just the most popular among our readers over the last seven days. There were 33 new articles published in the last week.

To ensure you always stay up to date with Artemis and never miss a story subscribe to our weekly email newsletter which is delivered every Wednesday.

View the current breakdown of the ILS market in our range of charts, allowing you to analyse cat bond issuance.

Check out the assets under management of the ILS fund market with our ILS investment manager directory.

Get listed in our MarketView directory of professionals.