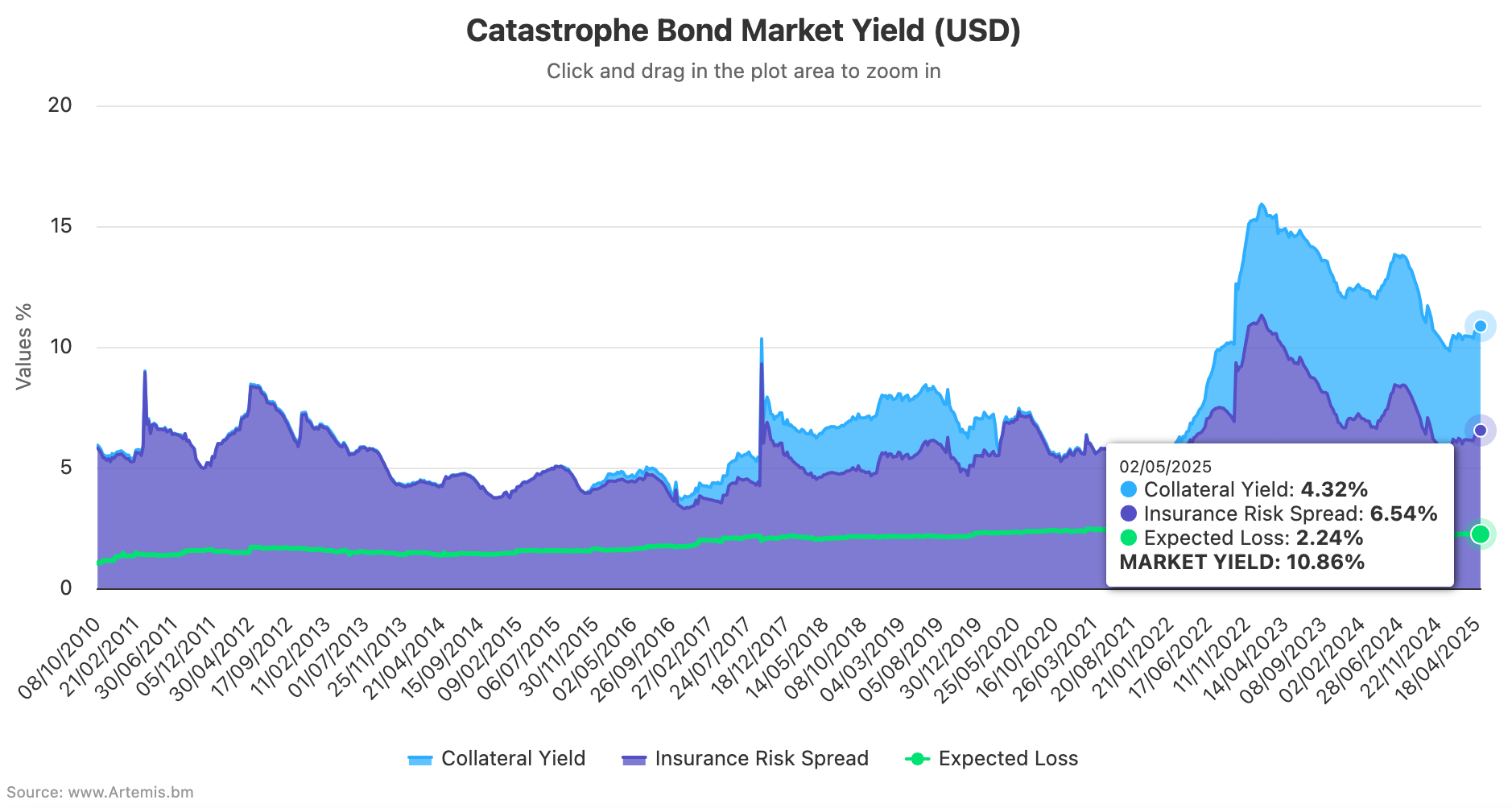

Catastrophe bonds widen in April as seasonality lifts market yield back to 10.86%

Having competed with demand for a couple of months, seasonality seemingly took over in the catastrophe bond market in April 2025, as spread widening returned and lifted the overall yield of the catastrophe bond market to 10.86% by May 2nd, according to the latest data from Plenum Investments.

That’s a 0.43% increase from the catastrophe bond market yield figure for the end of March 2025 in just one month, almost all of which has come from spread widening effects generated by seasonality, it appears.

One month ago, the overall yield of the catastrophe bond market sat at 10.43% and the figure had been moving sideways for a couple of months, as the opposing forces of seasonality and demand remained in joint-control.

Looking back, in late 2024 high-demand for catastrophe bond investments compressed risk spreads across the sector, which resulted in the cat bond market yield falling back into single digits at 9.94%, by the end of December 2024.

Mark-to-market impacts of realised and unrealised losses due to the California wildfires caused price adjustments in the catastrophe bond market in January 2025, which drove the overall market yield back into double-digit territory, at 10.34% in USD.

Then, February saw the opposing or competing forces of demand and seasonality taking hold, with the cat bond market yield settling at 10.44% in USD at the end of that month, with those effects persisting through March, resulting in a cat bond market yield of 10.43% in USD.

Now, Plenum Investments has noted that more typical seasonal effects drove the yield of the catastrophe bond market higher through April, resulting in an increase and a cat bond market yield of 10.86% in USD as of May 2nd.

The 10.86% catastrophe bond market yield as of the start of May 2025, driven by its components of a 6.54% insurance risk spread and a 4.32% collateral yield remains a historically attractive level of yield for investors in the cat bond market.

The insurance risk spread component increased from 6.13% at the end of March to the new level of 6.54%, on the back of seasonal spread widening.

Plenum Investments noted, “The market returning to its seasonal pattern of widening spreads and falling prices

for US hurricane bonds,” further explaining that, “With a decreasing primary market pipeline, we expect this trend to continue during the next two months.”

As a result, the overall yield of the catastrophe bond market is likely to rise further, on the back of wider spreads. But whether it will reach levels seen in summer 2024 remains to be seen, given the slight softening seen across market issuance pricing so far this year.

A year ago, on May 3rd 2024, the overall cat bond market yield stood at 12.78%, with an insurance risk spread component of 7.38% and a slightly higher collateral yield at 5.4%.

As a result, the insurance risk spread component of the cat bond market yield is down approximately 11% year-on-year as of the start of May 2025.

Analyse catastrophe bond market yields over time using this chart.