Alternative capital the main source of inflow to reinsurance in 2024: Gallagher Re

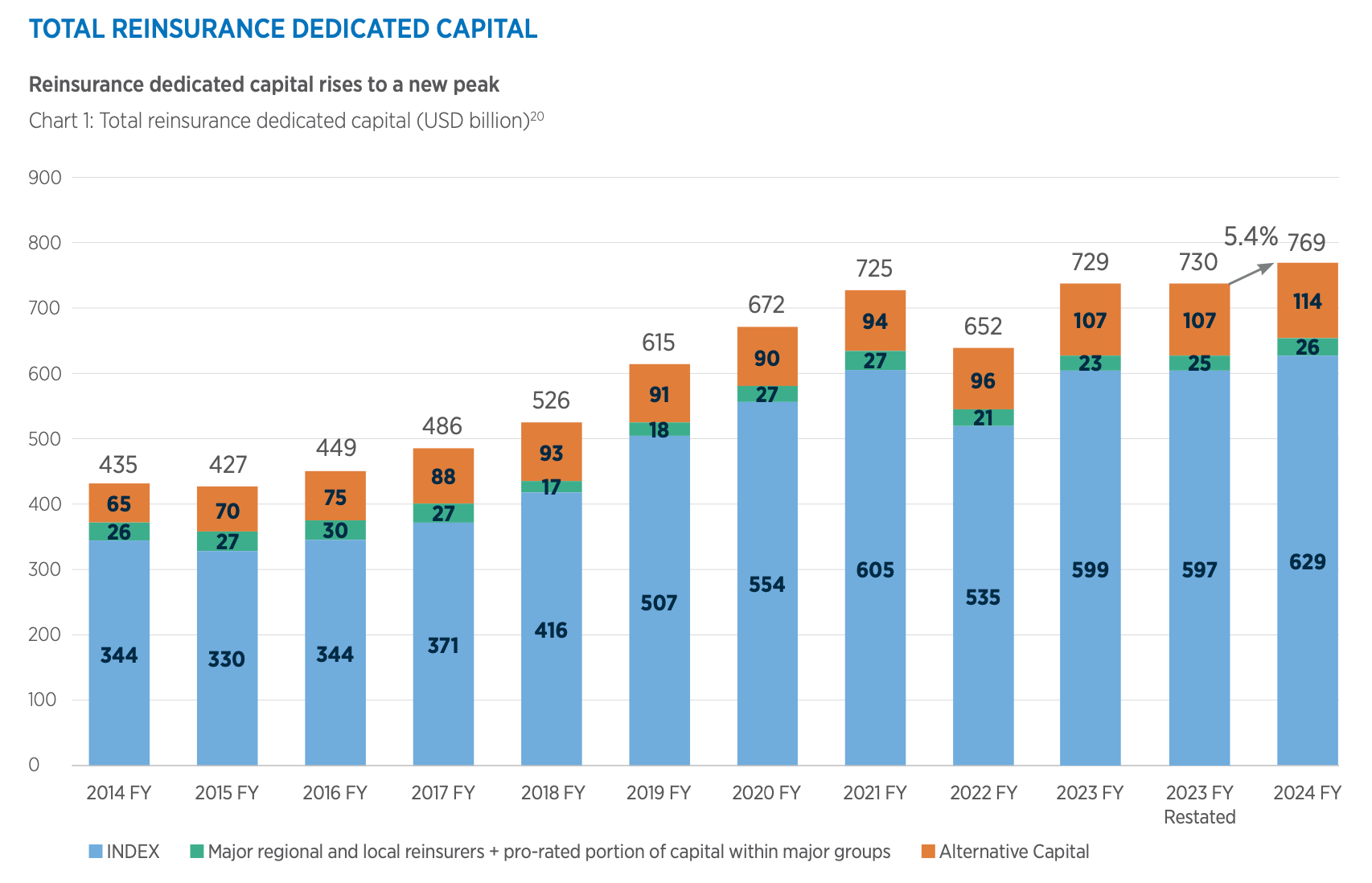

As alternative reinsurance capital, from catastrophe bonds and other non-life insurance-linked securities (ILS) structures, grew to a new high of US $114 billion by the end of 2024, Gallagher Re notes that it was the main source of capital inflow to the reinsurance market last year.

While traditional reinsurance capital also grew in 2024, to reach $629 billion, it was retained earnings that have been the main driver of that expansion.

This follows other recent years, when it has been retained earnings and investment asset value growth on the traditional side which has been expanding reinsurance.

While alternative reinsurance capital growth has been the main channel through which investors have been deploying new funds to support reinsurance business.

In 2024, overall dedicated reinsurance capital expanded by 5.4% during the year, with Gallagher Re’s Index subset of those reinsurers growing 5.3%.

Alternative and ILS capital in reinsurance grew fastest though, at a 6.6% pace during 2024, according to Gallagher Re’s data.

Overall dedicated reinsurance capital reached $769 billion at the end of 2024, made up of $629 billion of capital from Gallagher Re’s Index subset of reinsurers, plus $114 billion of alternative and ILS market capital, and $26 billion from major regional and local reinsurers with a pro-rated portion of capital from major groups.

While retained profits was the main driver for traditional reinsurance capital in 2024, for the insurance-linked securities (ILS) market it was catastrophe bonds.

Inflows to the cat bond market were the main driver of the 6.6% growth rate of alternative reinsurance capital during 2024, Gallagher Re explained.

The capital markets and insurance-linked securities (ILS) investors continue to be the main source of incremental capital growth through new inflows to the reinsurance market.

ILS structures continue to be the preferred vehicle for deploying capital to support re/insurers, while also now seemingly the preferred way for private equity to back new pools of underwriting as well.

At some stage in the future, perhaps further down the cycle path, it will become more attractive to stand-up entirely new equity balance-sheets in reinsurance. But, for now, we suspect these trends may continue, with ILS and capital market plumbing being the most efficient route for any investor to deploy new capital into reinsurance at-scale.

The data from reinsurance broker Gallagher Re can be compared to Aon’s, with that broker seeing alternative reinsurance capital slightly larger at $115 billion by the end of 2024, and having expanded slightly faster at 7% over the course of last year.

Gallagher Re has forecast that traditional reinsurance capital could grow a further 6% in 2025, on expectations of still-strong earnings at this stage.

The way alternative capital and ILS is shaping up year-to-date, we would not be surprised to see alternative capital outpace traditional for growth in reinsurance again this year.